What is the #1 thing you need for a stable retirement?

What you need most in retirement is a steady flow of income. Your net worth means nothing if you don’t have enough money coming in each month to live life on your own terms.

What asset class has historically provided that steady flow of income most consistently?

***Commercial real estate***

Commercial real estate has a long history of being an attractive investment during both up and down-market cycles and should represent a major element in your retirement strategy.

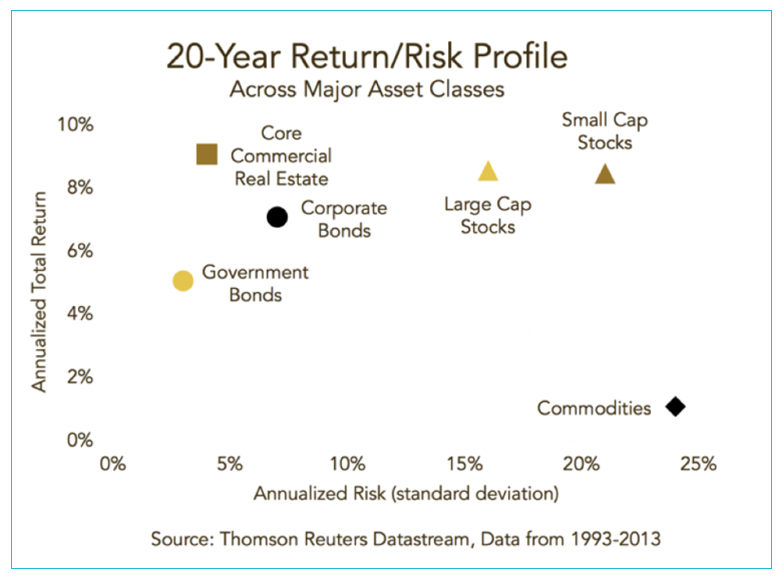

There are many ways to generate income for retirement, All investments care a certain level of risk and potential reward. But as the chart above illustrates commercial real estate has shown the highest returns with the lowest risk overall of all major investment categories over time.

Direct investment in commercial real estate also offers several benefits including:

- Stability

- Portfolio diversification

- Strong cash flow

- Appreciation of the underlying asset

Attractive Returns

Institutional and private investors have long used commercial real estate as a backbone to their portfolios because of its high long-term yields. Real estate returns are more attractive than traditional investments in stocks, bonds and annuities, due to decreased volatility, lack of fees, and inherent tax benefits.

Top Six Reasons Why Commercial Real Estate should make up a significant portion of your Retirement plan.

Cash Flow

Commercial Real Estate investments typically deliver steady cash flow with income distributed to investors monthly, quarterly or annually. First Floor Equity investments involve buying underperforming assets, such as hotels, office, or multifamily buildings. We then reposition or repurpose these assets to deliver what most investors seek—steady or rising cash flow over time.

Leverage

This is the use of a small initial cash investment to gain a high return in relation to one’s investment. Typically for investment properties, banks only require an investment of 25 to 35 percent of the asset’s purchase price in cash as equity.

Asset Appreciation

Real estate investments typically increase in value over the long term. This appreciation typically comes from rising rents or from the market valuing the income more highly. Investors have the opportunity to boost their overall investment return by cashing in on property appreciation once the asset is sold or refinanced.

Tangible Assets

Another key advantage of real estate investing is that it is a good way to diversify portfolios with hard assets. Real estate is not the same as buying shares in a company that may be here today and gone tomorrow. Real estate is an asset class that investors can literally touch and feel. While some building occupants may come and go, and there may be ups and downs in building valuations over the course of its life, the property itself is not going to disappear.

Inflation Hedge

Investors widely consider commercial real estate an asset class that can help offset the impact of inflation over the long term. In fact, that benefit is regularly cited as one of the advantages of adding real estate to a mixed-asset portfolio of investments. The ability to adjust rents over time is typically credited for real estate’s inflation-hedging benefits.

To A STABLE Retirement, and Beyond!

There are many, many ways to generate passive income for retirement. but commercial real estate is one of the best, so let’s get started.

Once you do, that little passive income snowball will keep getting bigger and bigger, and soon, you’ll spend all your time living your retirement, and no time at all worrying about paying for it.

If you’re interested in leveraging passive commercial real estate investments on your journey to build a stable retirement, a great place to start is by joining the First Floor Equity Investor Club. You will receive our biweekly newsletter and get access to an exclusive collection of investment opportunities that will allow you to passively build wealth for your families and live life on your own terms.

0 Comments